How to Fill Out the FAFSA When You Have More Than One Child at College

Letthis formula breaks down:

Continue the conversation on Facebook or Twitter.

- Child 1 account balance: $20,000

- Child 2 account balance: $13,000

- Child 3 account balance: $8,000

Can I move my information from 1 kid’s FAFSA form to another so I don’t have to re-enter it?

IMPORTANT: Regardless of who starts the application from this screen, the FAFSA form remains the student’s application; so when the FAFSA form says “you” it means the student.

You would add $41,000 to some other parent investments you’re required to report and enter it when asked, “What is the net worth of your parents’ investments?” On each of your children’s FAFSAs.

How many FSA IDs will my children and I need? How FAFSAs do we have to finish?

NOTE: If you have a third (or fourth, fifth, etc.) child who needs to fill out the FAFSA form and provide your information, repeat this process until you’ve finished all your children’s FAFSA forms.

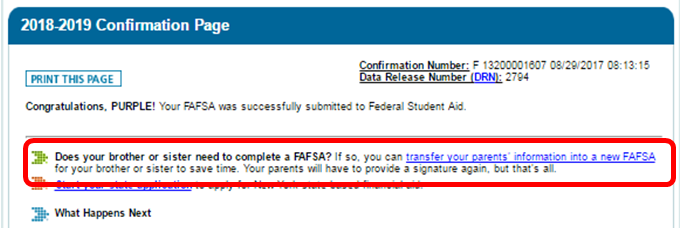

You’ll then see the alert below confirming that you want to transfer your information to another FAFSA.Photo by Getty Images

Example: Let’s assume that all of your dependent children have equal financial information and that the calculated EFC assuming one kid in college would be $10,000. Here’s how each child’s EFC would change depending on the amount of family members attending college full-time.

TIP: If you want the process to go as smoothly as possible, your second child should have his/her FSA ID handy so you’re ready for the next step.Note: Your FSA ID is related to your Social Security number and is equal to your legal signature; thus, each person can only have one FSA ID. If you are a parent, you may use the FSA ID to sign all your children’s FAFSA forms.

Yes! Once your first kid’s FAFSA form is complete, you’ll get to a confirmation page. On the confirmation page, you’ll see a hyperlink that says, “transfer your parents’ information to a new FAFSA.”

Financial need: Please note that schools differ (sometimes greatly) in their ability to satisfy each student’s financial need. To compare average school prices schools based on family income, take a look at the CollegeScorecard.ed.gov.

Schools use the following formula to determine a student’s eligibility for need-based financial aid:

Number of dependent children in college full-time Each child’s EFC 1 $10,000 Two $5,000 3 $3,333 4 $2,500 Each student and one parent need an FSA ID and all your children will need to complete a FAFSA. Your children will need to provide your (parent) information on their 2018–19 FAFSA forms unless they will graduate school, were born before January 1, 1995, or can answer “yes” to any of these questions.

Needing to help numerous children may feel like a lot to manage, although having can be stressful. While I can’t save you from a forgotten application deadline or the “how to do your own laundry” course, hopefully, I will help make the financial aid part of the process run more smoothly with these tips:

Published at Fri, 29 Sep 2017 14:42:00 +0000

I have education savings accounts (529 plan, etc.) for my children.

Cost of attendance (COA) — Expected Family Contribution (EFC) = financial need

Cost of attendance: This will vary by school, so if you have two children attending different schools with different costs, their financial need may be different, even if their EFC is the same.

How does having more than one kid in college impact the amount of financial aid my children qualify for?

An FSA ID is a username and password combination that serves as your legal digital signature throughout the financial aid process–from the first time your children fill out the Free Application for Federal Student Aid ( FAFSA®) form until the time their loans are repaid. You AND all your children will need your FSA ID. Parents and students can create their FSA IDs here.

Example: You have three children that are going to or who are in college. You’ll need four FSA IDs–one for you as the parent (only 1 parent needs an FSA ID) and one for each kid. You’ll want to fill out three FAFSA forms, one per child.Expected Family Contribution: The information you provide on the FAFSA form is used to calculate your child’s Expected Family Contribution (EFC). The EFC is a combination of how much a student and parent are expected to contribute towards the student’s cost to attend college. The EFC is not the quantity of money your family will have to pay for college, nor is it the quantity of federal student aid you’ll get. It is a number used by your child’s school to compute just how much aid she or he is eligible to receive. The expected parent contribution portion divides by the number since we recognize that a parent ability to pay does not change because you have children enroll in college.

Having children enrolled in college at the time might have an influence on your children’s eligibility for federal financial aid.

Nicole Callahan is a Digital Engagement Strategist at the U.S. Department of Education’s office of Federal Student Aid.

Example: Child 1 and 2 are filling out the FAFSA. Child 3 is in 8th grade. They all have 529 college savings plan accounts in their names.

For more info.) If you have education savings account for numerous children, you must report the combined present value of those accounts, even if some of those children aren’t in college yet or aren’t completing a FAFSA form.

TIP: We often hear about families who choose not to complete the FAFSA form again because they believe that they won’t qualify for grants or scholarships, especially if they didn’t qualify the previous year. This is a huge mistake, especially if you will have additional children entering college. Read on to learn why.

Source: TPd Paying for College Feed

Leave a Reply