* If you are a dependent student, the value of any college savings account should be reported as a parent asset, not a student asset.

The official FAFSA site is fafsa.gov. gov”! You don’t have to pay to complete the FAFSA form. If you are asked to provide credit card information, you are not on the official government site.

Not Reading Definitions Carefully

5.

Published at Mon, 25 Sep 2017 14:54:18 +0000

So students answer every single question that is asked, but fail to actually sign the FAFSA form with their FSA ID and submit it. This occurs for many reasons–perhaps you forgot your FSA ID, or your parent isn’t with you to sign with the parent FSA ID–so your application is left incomplete. Do not let this happen to you.

If you want to get the most financial aid possible, complete the FAFSA form ASAP after Oct. 1. Some financial aid is given on a first-come, first-served foundation, and some countries and colleges run out of cash early. If it feels like your college’s deadline is far off in the long run, get your FAFSA form done ASAP. The 2018–19 FAFSA form requiresso there’s no excuse to wait!

Photo at the top by Getty Images.

12. Not Signing the FAFSA Form

This is a mistake unless you know where you are going to school or already are currently applying to only one college. Colleges can’t see so you should add ALL colleges you are considering to your FAFSA form, even if you are not sure whether you will apply or be accepted. You can add up to 10 schools at one time. If you are applying to more than 10 schools, follow these steps.

- Legal guardianship–To determine your dependency status, the FAFSA form asks, “Does someone other than your parent or stepparent have legal guardianship of you, as determined by a court in your state of legal residence?” Many students incorrectly answer “yes” here. For this query, the definition of legal guardianship does not include your parents–even if they had been appointed by a court to be your guardians. You’re not your guardian.

- Parent–The FAFSA form has very specific guidelines about which parent’s information needs to be reported. Spoiler alert: It has nothing to do with who claims you.

On the FAFSA form you may be asked, “As of today, what is the marital status of your parents? ” If your biological parents are divorced, however, the parent with whom you lived more over the previous 12 months is remarried, answer “remarried” and enter information about that parent and his or her spouse. If your biological parents are divorced and only the parent with whom you lived less is remarried, or if neither of your parents are remarried, answer “divorced.”

- Number of family members (household size)–The FAFSA form has a specific definition of how your household size or your parents’ household size should be determined. Many students incorrectly report this number, especially when the student doesn’t physically live with the parent.

- Number of family members in college–Enter the number of people in your (or your parents’) household who will attend college at the same time as you. Do not include your parents even when they’re in college, although don’t forget to include yourself. This number shouldn’t be higher.

- Net worth of investments—We have outlined some specific items that should and should not be included as investments on the FAFSA form. For instance, a college savings plan such as a 529 account is considered an investment*, while the value of the house in which you reside and the value of your retirement account aren’t. We highly recommend that you read this to make sure you are reporting this information properly.

- Taxable college grants and scholarships–For this question, you report only college grant and scholarship amounts that were reported to the IRS as income. That means you shouldn’t use the amount listed on your 1098-T; you should report the amount listed on your tax return. Do not use the number from the adjusted gross income (AGI) field. Here are the tax line numbers you should reference when asked this question. If you did not file taxes, you should enter zero.

Here are some items that have very specific (but not necessarily intuitive) definitions according to the FAFSA:

I hear all sorts of reasons: “The FAFSA form is too hard.” “It takes too long to complete.” “I’ll never qualify anyway, so why does it matter?” It does matter. For one, contrary to popular belief, there’s no income “cut-off” when it comes to federal student aid. Also, the FAFSA form isn’t just the application for federal grants such as the Federal Pell Grant, it is also the application for Federal Work-Study funds, federal student loans, as well as scholarships and grants offered by your state, school, or private organization. If you don’t complete the FAFSA form, you could lose out on tens of thousands of dollars that will help you pay for college. It takes very little time to complete, and there are “Help and Hints” provided throughout the application.

Note: The IRS DRT will return with the 2018–19 FAFSA form on Oct. 1, 2017, with added security and privacy protections added.

Here are some examples of common errors we see when people complete the FAFSA form:

3.

Note: If you are a resident of certain states, the sequence in which you list the schools on your FAFSA form could issue. Find out whether your state has a requirement for the order in which you list schools on your FAFSA form.

Starting with the 2018–19 FAFSA form, the data transferred from the IRS to your FAFSA form will be displayed online. You won’t see your tax information when your data is successfully transferred. Instead, the data fields will display the message “Transferred from the IRS.”

Not Using Your FSA ID to Start the FAFSA Form

Not Using the Correct Website

If you want to get the most financial aid possible, complete the FAFSA form ASAP after Oct. 1. Some financial aid is given on a first-come, first-served foundation, and some countries and colleges run out of cash early. If it feels like your college’s deadline is far off in the long run, get your FAFSA form done ASAP. The 2018–19 FAFSA form requiresso there’s no excuse to wait!

Photo at the top by Getty Images.

On the FAFSA form you may be asked, “As of today, what is the marital status of your parents? ” If your biological parents are divorced, however, the parent with whom you lived more over the previous 12 months is remarried, answer “remarried” and enter information about that parent and his or her spouse. If your biological parents are divorced and only the parent with whom you lived less is remarried, or if neither of your parents are remarried, answer “divorced.”

I hear all sorts of reasons: “The FAFSA form is too hard.” “It takes too long to complete.” “I’ll never qualify anyway, so why does it matter?” It does matter. For one, contrary to popular belief, there’s no income “cut-off” when it comes to federal student aid. Also, the FAFSA form isn’t just the application for federal grants such as the Federal Pell Grant, it is also the application for Federal Work-Study funds, federal student loans, as well as scholarships and grants offered by your state, school, or private organization. If you don’t complete the FAFSA form, you could lose out on tens of thousands of dollars that will help you pay for college. It takes very little time to complete, and there are “Help and Hints” provided throughout the application.

Here are some examples of common errors we see when people complete the FAFSA form:

Note: If you are a resident of certain states, the sequence in which you list the schools on your FAFSA form could issue. Find out whether your state has a requirement for the order in which you list schools on your FAFSA form.

Starting with the 2018–19 FAFSA form, the data transferred from the IRS to your FAFSA form will be displayed online. You won’t see your tax information when your data is successfully transferred. Instead, the data fields will display the message “Transferred from the IRS.”

Not Using Your FSA ID to Start the FAFSA Form

It doesn’t hurt your application to include more schools. In fact, you don’t even have to remove. If you don’t wind up applying or getting accepted to a school, the school can disregard your FAFSA form. However, schools can be removed by you at any time to make room.

- Confusing parent information with student information–I know there are lots of parents out there who fill out the FAFSA form for their children, but bear in mind, it is the student’s application. When the FAFSA form says “you” or “your,” it is referring to the pupil, so make sure to enter your (the student’s) information. It is going to specify that in the question if the form is requesting your parent’s information.

- Entering information that doesn’t fit your FSA ID information–After you make an FSA ID, your data (name, Social Security number, date of birth) is delivered to the Social Security Administration to be verified. If you enter another name, Social Security number, and/or date of arrival on the FAFSA form, you will get an error message. This is frequently caused by mixing up parent information and student information or a typo. To avoid delays in completing and processing your application, triple-check that you’ve entered your information. If you experience this error, here is how you can solve the error.

- Amount of your income tax: Here, the FAFSA form is requesting your assessed income tax liability, not the amount of income tax withheld rather than your AGI. I know this can be complex. To avoid this common mistake, either move your tax information to the FAFSA form using the IRS DRT, or click here to find out which tax line number you should refer to when answering this question. (Note: It depends on which IRS form you filed.)

10. Not Reporting Required Information

- Parent information–Even if you fully support yourself, pay your own bills, and file your own taxes, you might still be considered a dependent student for federal student aid purposes. In that case, you must provide parent information on your FAFSA form. Dependency guidelines for the FAFSA form are determined by Congress and are different from those of the IRS. Find out whether you will need to provide parent information by answering these queries. If you are considered a dependent student and don’t provide parent information, your FAFSA form might not be processed, you might not get an Expected Family Contribution, and/or you might qualify for unsubsidized loans only.

- Additional financial information–If you follow our recommendation and use the IRS DRT, plenty of the financial information required on the FAFSA will be automatically filled in for you. However, the IRS DRT doesn’t populate all of the financial questions on the FAFSA form; some numbers, including many items in the “Additional Financial Information” section, must be manually entered. If you used the IRS DRT, you will see that some boxes in that section are prechecked as well as the fields prefilled with “Transferred from the IRS.” Those products were available to be moved from the IRS. However, other items, such as “Payments to tax-deferred pension and retirement savings plans” and others, can’t be transferred from the IRS. By referencing your relevant records you must examine each item in the list, check the box if it applies to you , and enter the amount. In the case of obligations to pension and retirement savings programs, you can find that information on your W-2 form.

11. Listing Just One college

IMPORTANT: We recommend that you, the student, start the FAFSA so you can choose the option “Enter your (the student’s) FSA ID.” However, if you are a parent who’s beginning a FAFSA on your child’s behalf, you should use the option “Enter the student’s information” since you ought not know your kid’s FSA ID. .

2) Enter the student’s information

As I said, you should complete the FAFSA form as soon as possible after Oct. 1, but you should DEFINITELY fill it out before your earliest FAFSA deadline. School and each state sets its own deadline, and some deadlines are very early. To be sure fill out your FAFSA form–and any other financial aid applicationsbefore the deadline.

It is important to get an FSA ID before filling out the FAFSA form. Why? Well, because when you register for an FSA ID, you might have to wait up to 3 times before you can use it to sign your FAFSA form electronically. An FSA ID is a username and password that you use to log into some U.S. Department of Education sites, including fafsa.gov. You AND your parent (if you are considered a dependent student) will each need your own, independent FSA IDs if you both want to sign your FAFSA form online. DO NOT discuss your FSA IDs with each other! Doing this could cause delays or problems .

If you are the student, the first option should be chosen by you. Why? When you do, a number of your personal information (name, Social Security number, date of birth, etc.) will be automatically loaded into your own application. This will stop you from running into a common mistake that occurs when your verified FSA ID information doesn’t match the data on your FAFSA form. You won’t have to put in your FSA ID again to transfer your data from the IRS or to sign your FAFSA form.

- If you don’t know your FSA ID, select “Forgot username” and/or “Forgot password.”

- If you don’t have an FSA ID, create 1.

9. Inputting Incorrect Information

4.

1. Not Completing the FAFSA Form

If you’re not able to sign with your FSA ID, there’s an option to mail a signature page. If you want confirmation that your FAFSA form has been submitted, you can check your status immediately after you submit your FAFSA form online.

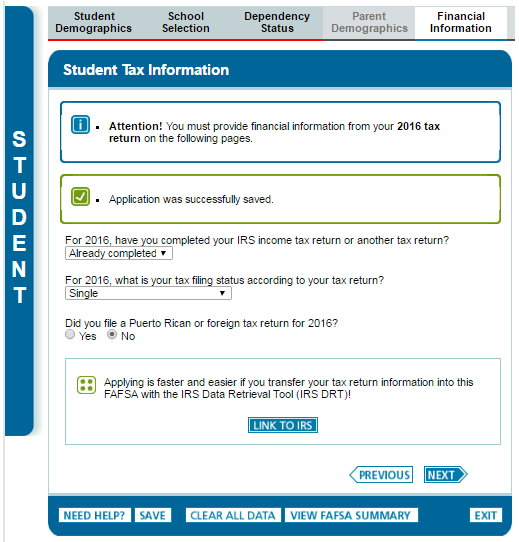

For applicants, the most difficult part about filling out the FAFSA form is entering the financial information. But thanks to a partnership with the IRS, pupils and parents who are qualified can automatically transfer their necessary 2016 tax information into the 2018–19 FAFSA form using the IRS DRT. It is the fastest, most accurate way to enter your tax return information into the FAFSA form, so if you are given the option to “LINK TO IRS” button, make the most of it!

For applicants, the most difficult part about filling out the FAFSA form is entering the financial information. But thanks to a partnership with the IRS, pupils and parents who are qualified can automatically transfer their necessary 2016 tax information into the 2018–19 FAFSA form using the IRS DRT. It is the fastest, most accurate way to enter your tax return information into the FAFSA form, so if you are given the option to “LINK TO IRS” button, make the most of it!

Leave a Reply